This week’s UK Property Market Stats Show for the week ending Sunday, 3rd November 2024, features special guest, Rob Smith (boss man of Hunters & Whitegates), to discuss the property market headlines for Week 44 of 2024.

The main headlines:

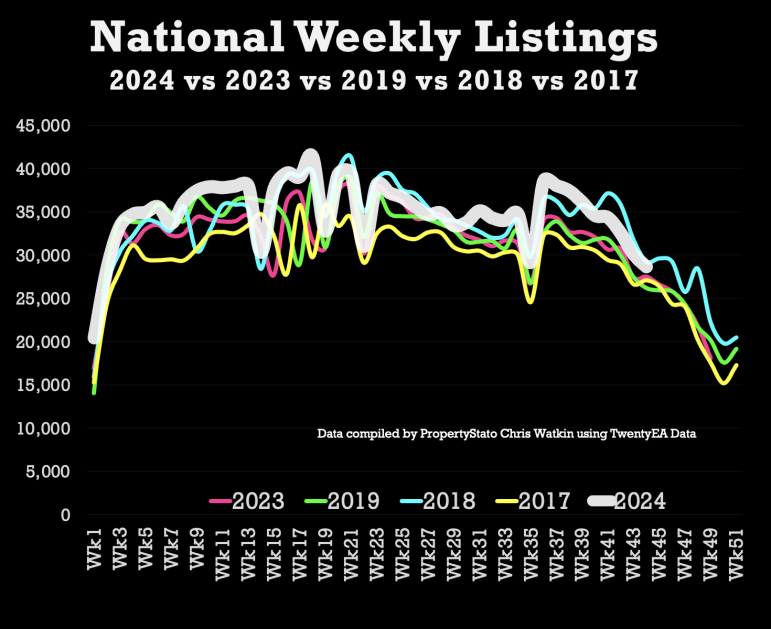

+ Listings (new properties coming on to the market) – 28.6k UK listings this week (week 44), an expected drop of 1.5k from last week. 8.1% higher 2024 YTD than 2023 YTD.

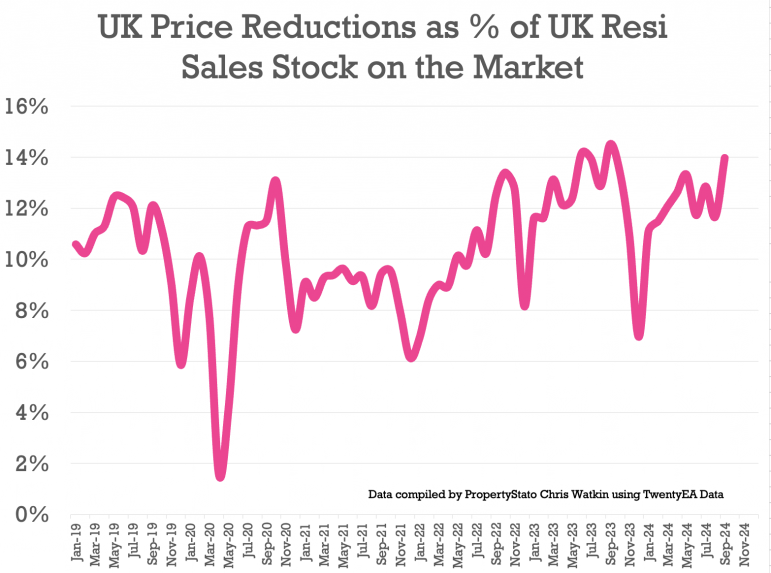

+ Percentage of residential sales stock being reduced (monthly): 13% of residential sales stock was reduced in the last month. Some 14% last month and long-term 5-year average 10.6%.

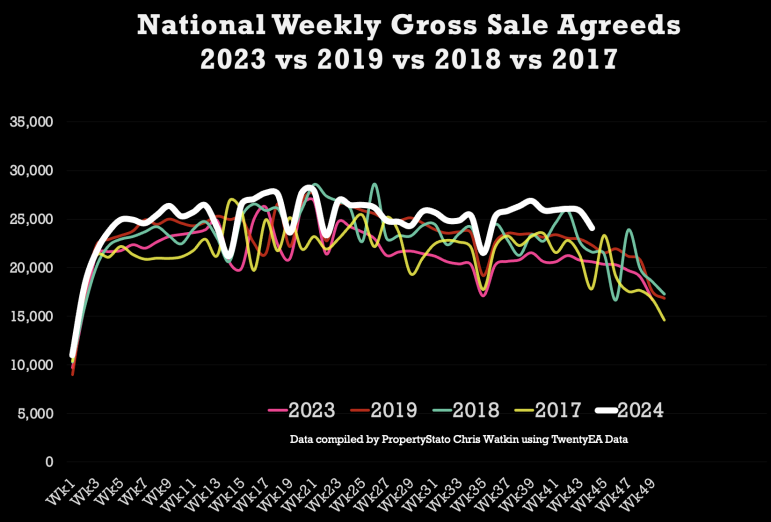

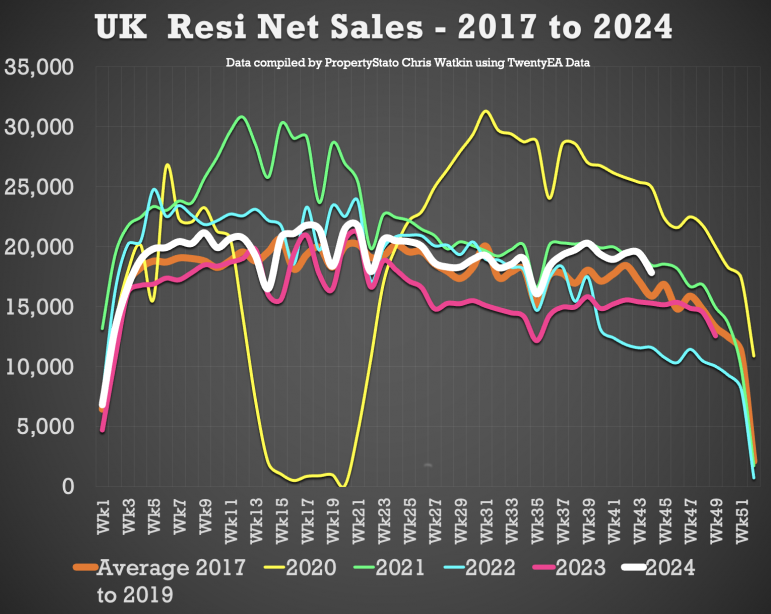

+ Total Gross Sales – 24k UK homes sold STC this week (Week 44); 6.9% lower than last week. Some 17% higher than the same standalone week (week 44) in 2023. Also, 7.4% higher than 2017/18/19 YTD levels and 14.8% higher than 2023 YTD levels.

Sale through rate (monthly): UK estate agents sold 16.11% of their residential property sales stock in Oct ’24. Sept ‘ 24 was 14.79%. 2024 average is 15.86% and the 7-year long term average is 17.9% per month – yet don’t forget that was only in mid/late 20%’s in the crazy years of 20/21/22).

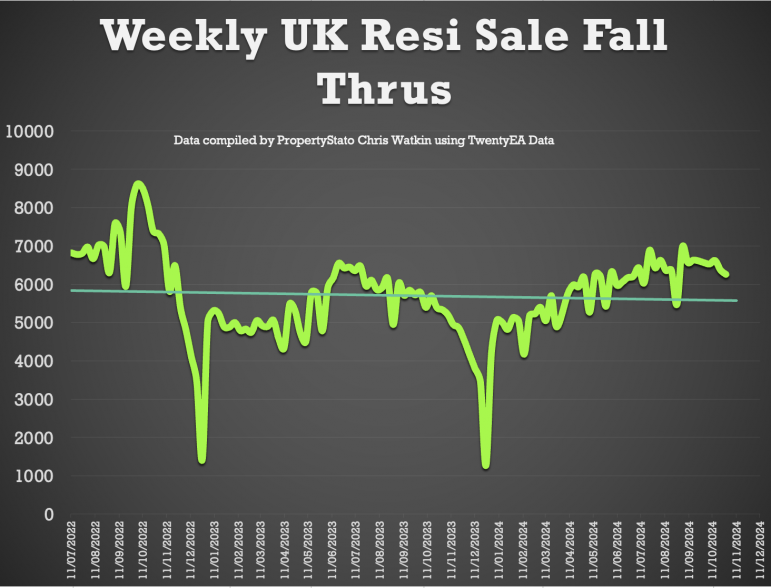

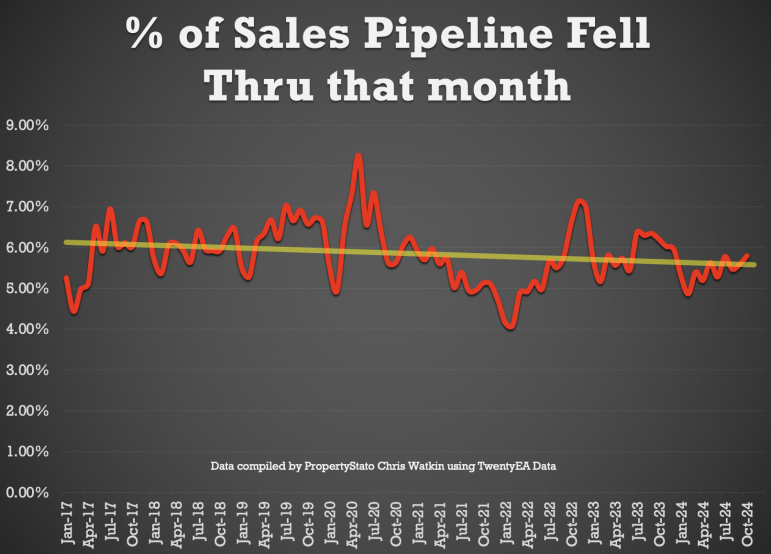

Sale fall-throughs – Agents lost 5.8% of their sales pipeline for the month (up from 5.6% in Sept ‘ 24). For the week 44, Sale Fall Thrus (as a % of Gross sales Agreed) increased slightly to 25.9% (up from 24.6% last week). The 7-year long=term weekly Average is 24.2% and it was 40%+ in the two months following the Truss Budget in the Autumn of 2022.

Net Sales – 17.8k this week (19.5k last week) – 17% higher than the same week 44 in 2023, 54% higher than the same week 44 in 2022 and still 17.4% higher YTD in 2024 compared to YTD 2023.

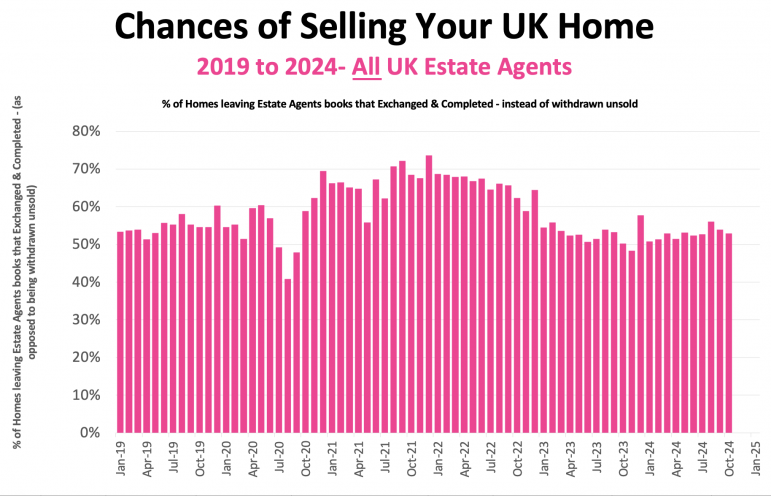

+ Percentage of homes exchanging Vs homes unsold – Of the 1,295,604 UK homes that left UK estate agents books since the 1st Jan 2024, 693,669 of them (53.54%) exchanged & completed contracts (meaning the homeowner moved and the estate agent got paid). The remaining 601,935 (46.46%) were withdrawn off the market, unsold. In essence you a flip of the coin chance of actually selling, homeowners moving and the estate agent getting paid.

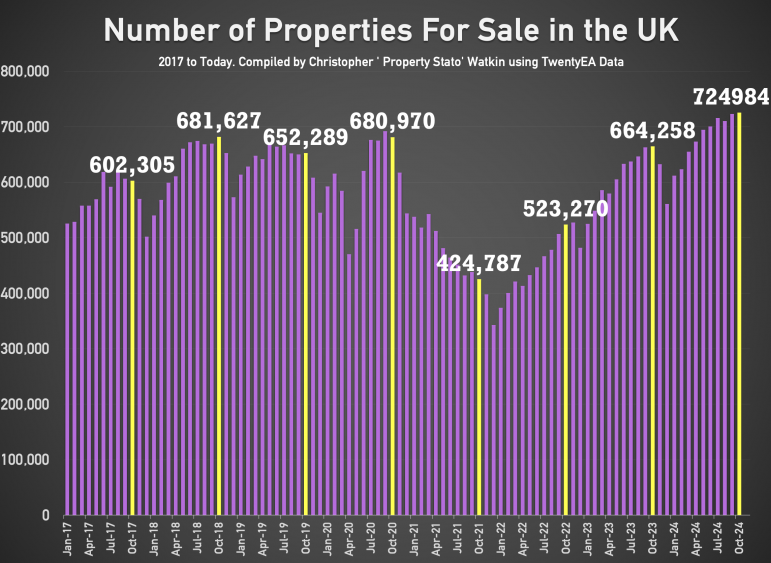

+ Residential property sales stock on the market (monthly stat) : 725k at end of October (up from 724k at end of Sept). For comparison, Oct ’23 – 664k, Oct ’22 – 523k, Oct ’21 – 425k, Oct ’20 – 681k, Oct ’19 – 652k.

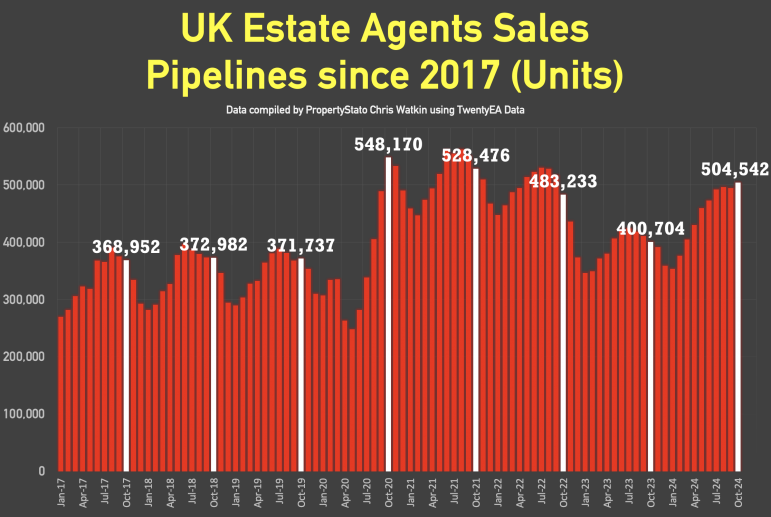

+ Residential property sales sold STC pipeline (units) (monthly stat): 505k at end of October. For comparison, Oct ’23 – 401k, Oct ’22 – 483k, Oct ’21 – 528k, Oct ’20 – 548k, Oct ’19 – 372k.

+ UK house prices – As explained in the show, the £/sqft figure foretells and predicts the Land Registry 5 months in advance with an accuracy rating of 92%. Final October figures saw a slight jump in this important metric to £346/sq.ft. For comparison – Sept’s £339/sq.ft, August’s £338/sq.ft, and July at £341/sq.ft. This means house prices have grown 1.47% in the last three months.

Local Focus this week – Putney (SW15) in London

Comments are closed.