The cost of renting in Scotland’s PRS is beginning to ease whilst policy measures for rent controls continue their journey through Parliament.

The cost of renting in Scotland’s PRS is beginning to ease whilst policy measures for rent controls continue their journey through Parliament.

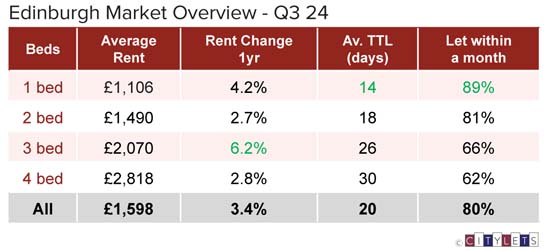

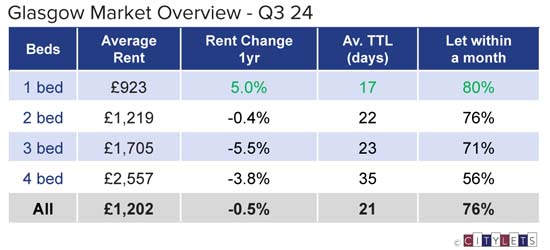

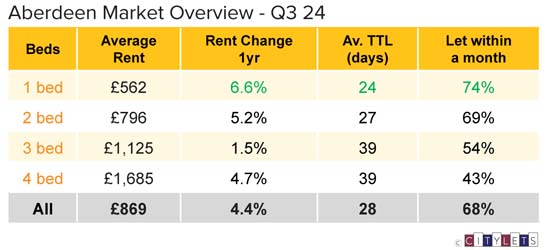

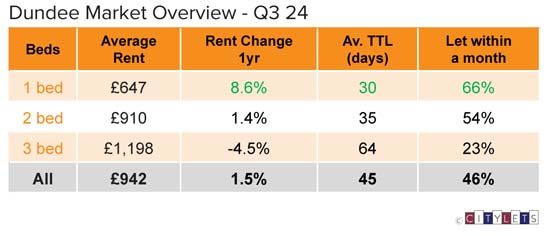

The latest report for Q3 2024 from Scottish lettings portal Citylets shows the rate of annual growth trending downward in the low single digits for all main cities. The city of Glasgow recorded a year on year (YOY) fall of minus 0.5%.

Under new leadership, the SNP administration has paid lip service to the need not to deter investment within the sector, however it will be a long and anxious wait for detail. Some commentators currently describe Scotland as ‘no go’ region for large scale investment which many regard as the natural form of rent control which will cool the market through supply expansion

Meanwhile, Scotland’s PRS continues to operate as a free market between tenancies and currently reminds policymakers, who may be amendable to reflection, that markets go down as well as up. The rate of annual growth is significantly reduced in the country’s largest markets suggesting an inflection point has arrived with falls in real terms to follow.

Citylets manging director, Thomas Ashdown, commented: “Rents in Scotland’s PRS are beginning to ease which will be welcome news for tenants, however the investment community awaits hard facts on mooted changes to the Housing Bill that have been suggested will alleviate nerves. Expanding the market supply is the natural form of rent control long term and one that does not put extra burden on already overstretched local councils.”

Once again the Scottish PRS finds itself subject to the opposing forces of free market dynamics and government policy. Supply and demand balance seems set to ease if BOE interest rates trend consistently lower as expected impacting on the availability of residential mortgages for both tenants and investors.”

Gillian Semmler, PR manager at Citylets, said: “It is noteworthy that these slowing figures have been recorded in what is traditionally the busiest time of the year. With associated lengthening of Time to Lets, it would be reasonable to believe that an inflection point has now been reached with falls in rents in absolute terms now a possible trend in some major Scottish markets.”

Ann Leslie of Lar Housing Trust said: “Edinburgh remains the most pressurised area and the removal of a required local connection for social housing is likely to exacerbate the problem. However, there are common themes across the country suggesting difficult times ahead. Pressure is mounting on the PRS, with various commentators highlighting that landlords are selling up in increasing numbers due to a perceived hostile political environment. This is, in turn, pushing more tenants towards the MMR sector and we have noticed a marked increase in enquiries in the last quarter. Demand from mature and PhD students, often with families, is also increasing and our waiting list would take a staggering 20 years to clear at current void rates.”

Comments are closed.