This week’s UK Property Market Stats Show, for week ending Sunday, 30th June 2024, features special guest, Kristian Stott.

This week’s UK Property Market Stats Show, for week ending Sunday, 30th June 2024, features special guest, Kristian Stott.

The headlines for Week 26 of 2024 are as follows:

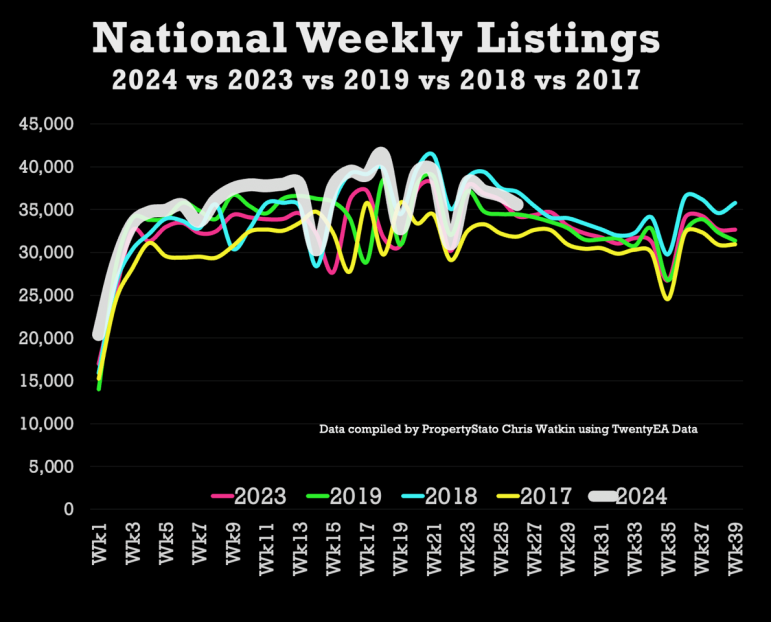

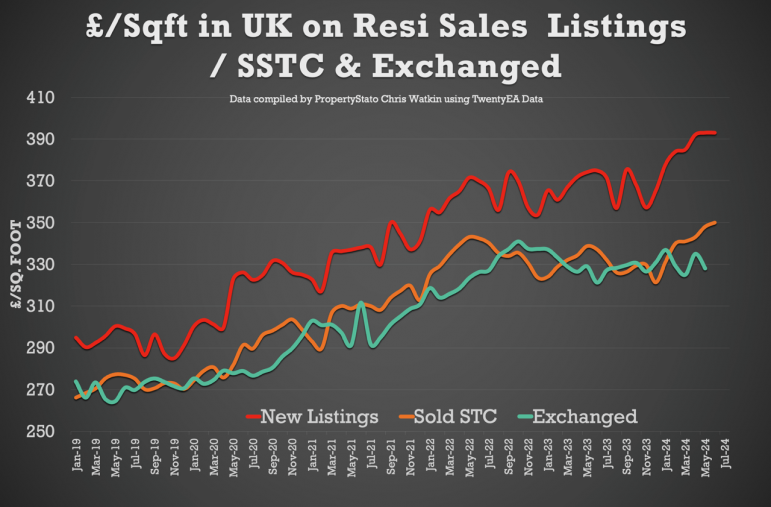

+ UK house prices on homes sold (stc) in June continue to remain strong at £348/sq.ft – 5.1% higher than Dec 2023 · Listings – 35.6k UK listings this week. 7.5% higher YTD than 2017/18/19/20 YTD average. · Total Gross Sales – 26,198 – 6.9% higher than 2017/18/19

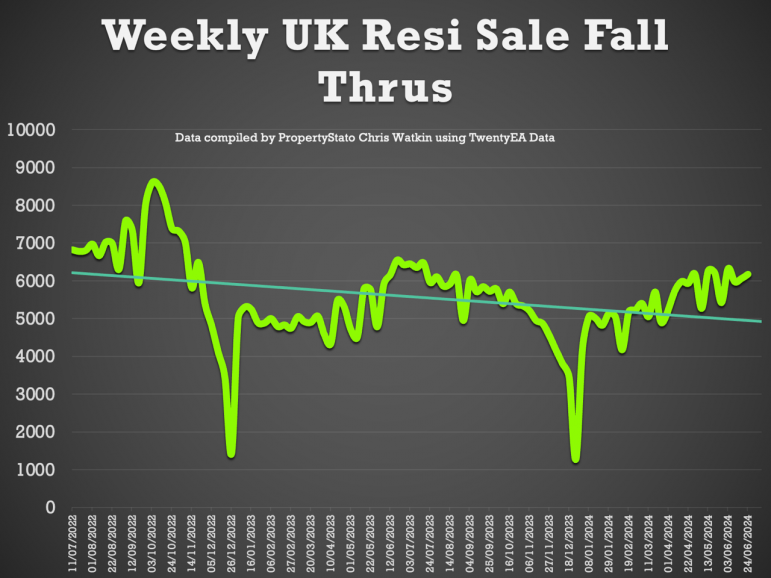

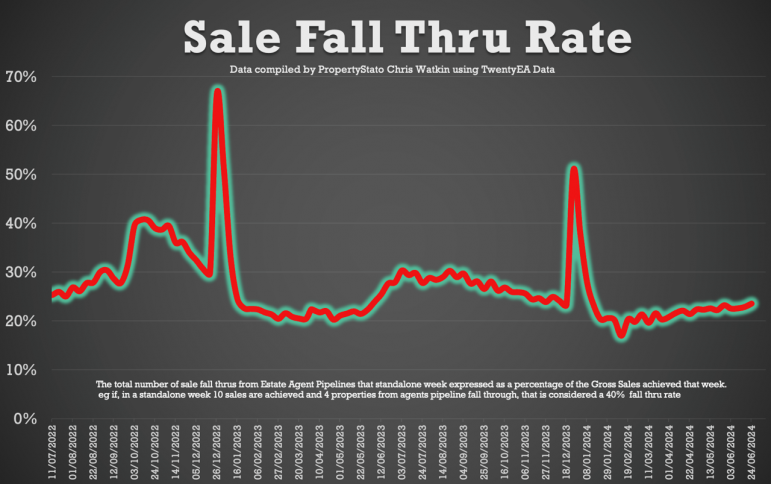

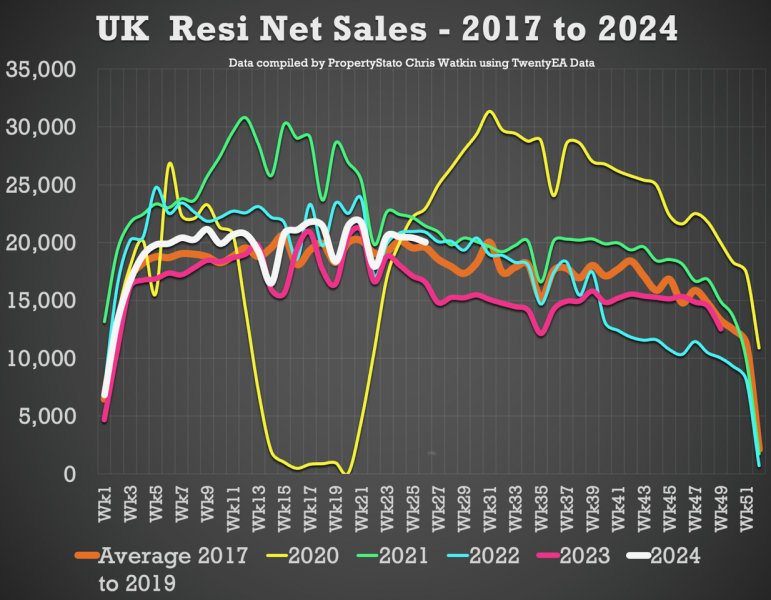

+ YTD levels, 6.4% higher than the 2024 weekly average & 10.2% higher than 2023 YTD levels. · Net Sales – 20,028 this week, 20.8% higher than the same Week in 2023. · Sale fall-throughs crept up slightly at just under 1 in 4 sales (23.5%) – 7 year Long Term

+ Average is 24.8% – so nothing to worry about .

Overall, the general election has had no real impact on the UK property market over the past month or so, as UK house prices achieved at SSTC are 5.1% higher than December 2023.

Chris’s In-Depth Analysis

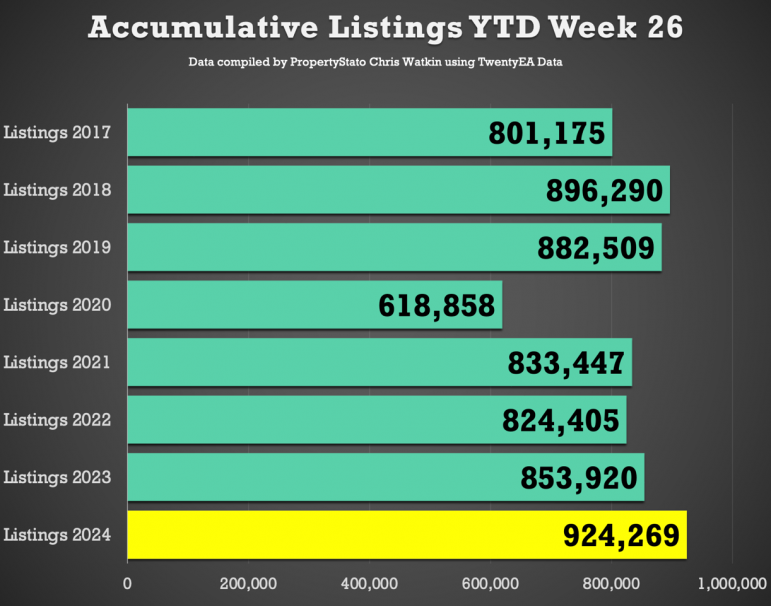

+ New Properties to Market: The UK saw 35,593 new listings. This year’s YTD listings stand at 924,269, 11.4% higher than the historical 8 year YTD average of 829,359, 7.5% higher than YTD 2017/18/19 and 8.2% higher YTD 2023. Weekly 2024 average: 35,549.

Average Listing Price: £442,177.

Average Asking Price of this week’s Listings vs Average Asking Price of the Properties that Sale Agreed this week: 21.1%. The long-term average is between 16% and 17%.

Price Reductions: Last week, 20,523 properties saw price reductions, higher compared to the 8-year Week 26 average of 18,230. Yet there is higher stock levels. Stock June levels are at 694,281. This means 1 in 8 properties each month are being reduced.

Average Asking Price for Reduced Properties: £401,075.

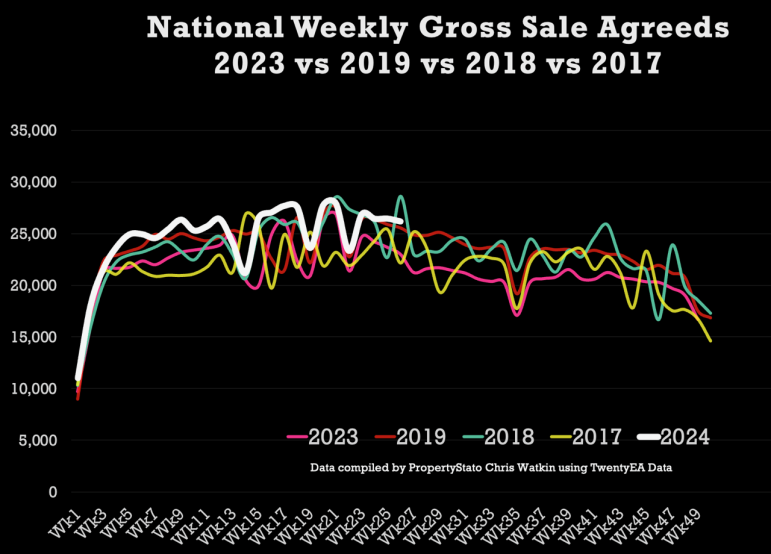

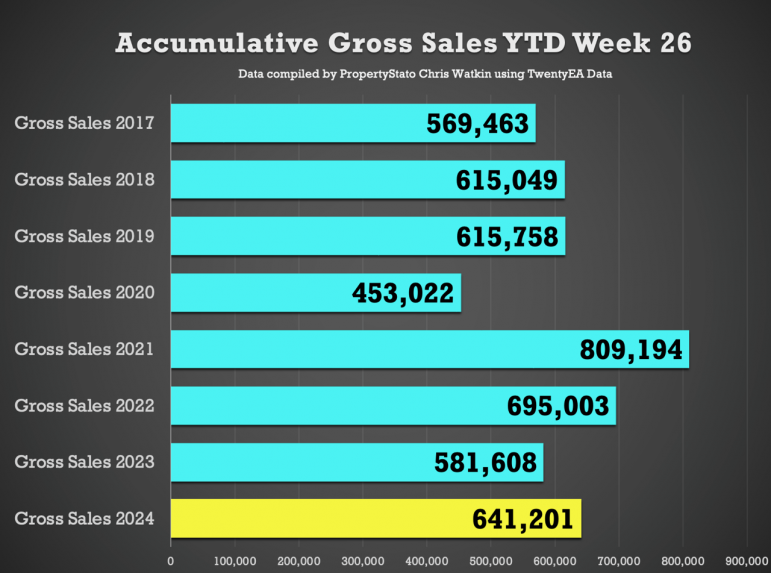

Gross Sales: 26,198 properties were sold stc last week (2024 weekly average : 24,661 Gross Sales).

Accumulative Gross Sales YTD: The total YTD stands at 641,201, exceeding the average YTD Gross sales figure of 600,090 from 2017/18/19 and 581,608 in the same week 26 in 2023.

* Average Asking Price of Sold STC Properties: Still staying in the mid £360/380k’s range (like has been for 2 years) at £371,233.

Sale Fall Throughs: Fall thrus this week at 6,170. Last 3 months weekly average 5,977.

* Sale Fall Through % Rate: Similar to last week at 23.6% for week 26. (Comparison – 22.5% for the last 3 months, whilst the long term 8 years average is 24.8% & it was 40%+ in Q4 2022 – the Truss budget!)

* Net Sales – 20,028 – 4.1% higher than the 2024 weekly average of 19,235.

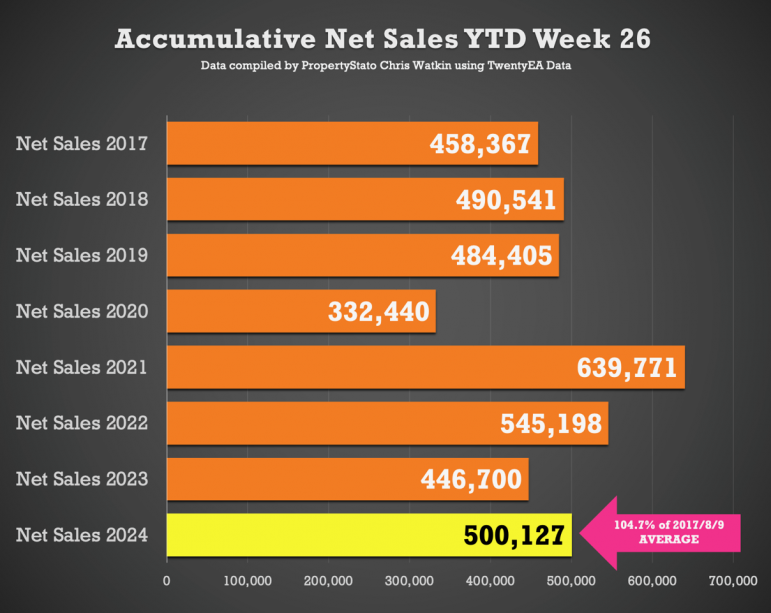

Accumulative Net Sales YTD: The total stands at 500,127, 4.7% higher the 17/18/19 YTD Net sales average (477,771) and 12% higher than the YTD figure for 2023 for Net Sales.

House Prices on the House sales agreed (SSTC)in June MTD are at £348/sq.ft. For comparison – in May ’24 in £348/sq.ft, April ’24 – £344/sq.ft, March ’24 – £339/sq.ft, Feb ’24 -£339/sq.ft & Jan ’24 to £331/sq.ft).

This week’s local focus is on Runcorn.

Comments are closed.