More than 19 out of every 20 buyers seeking a mortgage applied for a fixed rate product last month, analysis of the latest mortgage lending statistics show.

More than 19 out of every 20 buyers seeking a mortgage applied for a fixed rate product last month, analysis of the latest mortgage lending statistics show.

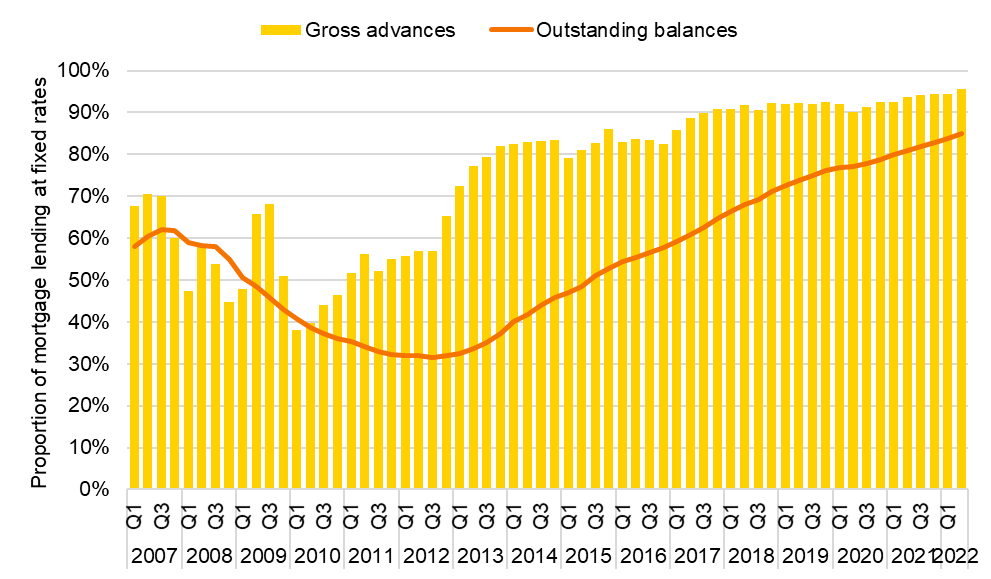

Some 95.5% of new buyers are taking out fixed rate mortgages, while the proportion of mortgaged homeowners who have fixed their rates is also at an all-time high, at 84.9%.

Lawrence Bowles, director of research at Savills, commented: “Once more, our most recent buyer survey from late August shows that borrowers are increasingly looking to fix for a longer period. 13% of respondents looking to finance their next purchase with a mortgage stated a preference for a ten-year fixed rate deal. And indeed, the vast majority [56%] are looking to take out a five-year fixed rate.

“The move to lock into existing rates, which are still low in a historical context, will help to insulate the UK housing market from increasing interest rates in the short-term. Especially as we expect the Monetary Policy Committee to raise rates once again later this month.

“However, the average mortgage rate lenders are offering in August was 3.64% [75% loan-to-value, 2-year fixed rate]. That rate is the highest it has been since September 2012 [3.67%]. The average mortgage rate for someone who fixed in 2022 Q2 was far lower, 2.14%. With rates so much higher now, we expect to see transaction activity and price growth slow in the mainstream market in the coming months.

“While in the prime market, equity outweighs debt as a source of funding, and more affluent buyers are better insulated against increased costs of living. As a result, we expect activity to remain steady.

Buyers can’t really go fixed to “lock in” today’s low rates, as fixed-rate mortgages have higher rates, to take into account the lender’s estimated increase in future rates.

In truth, no one knows what rates will do. There might be a recession and rates fall as the government attempts to print and spend their way out of the problem.

Everyone has their own theory, but no one knows what rates will actually do. Some people must think that rates will hold or fall for the next few years, so the 96% number is too high and needs a bit more explanation. Perhaps lenders offering better LTV ratios for 5-year fixed deals (perhaps suggesting banks think rates will hold or fall) is the real reason behind the popularity of fixed-rate deals?

Perhaps buyers choose fixed rates for those reasons and then justify their acceptance of this forced position by telling themselves they willingly chose to go fixed, because, as everyone knows; “rates are at historical lows”.

I don’t have a crystal ball, I don’t know what rates will do, and I don’t think 96% of buyers do either.

Sorry to rant, but it just seems like Savills missed the big story here and went for the lazy “self-evident” option that might turn out to be totally wrong. Is this real journalism?

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register